Survey: Inflation moderated again in Dec.

By Katherine K. Chan, A reporter

HEADLINE INFLATION may have fallen to a five-month low in December during the proceeding the price of rice is falling and it is cheap electricity costs, which may bring inflation throughout the year below target, say analysts.

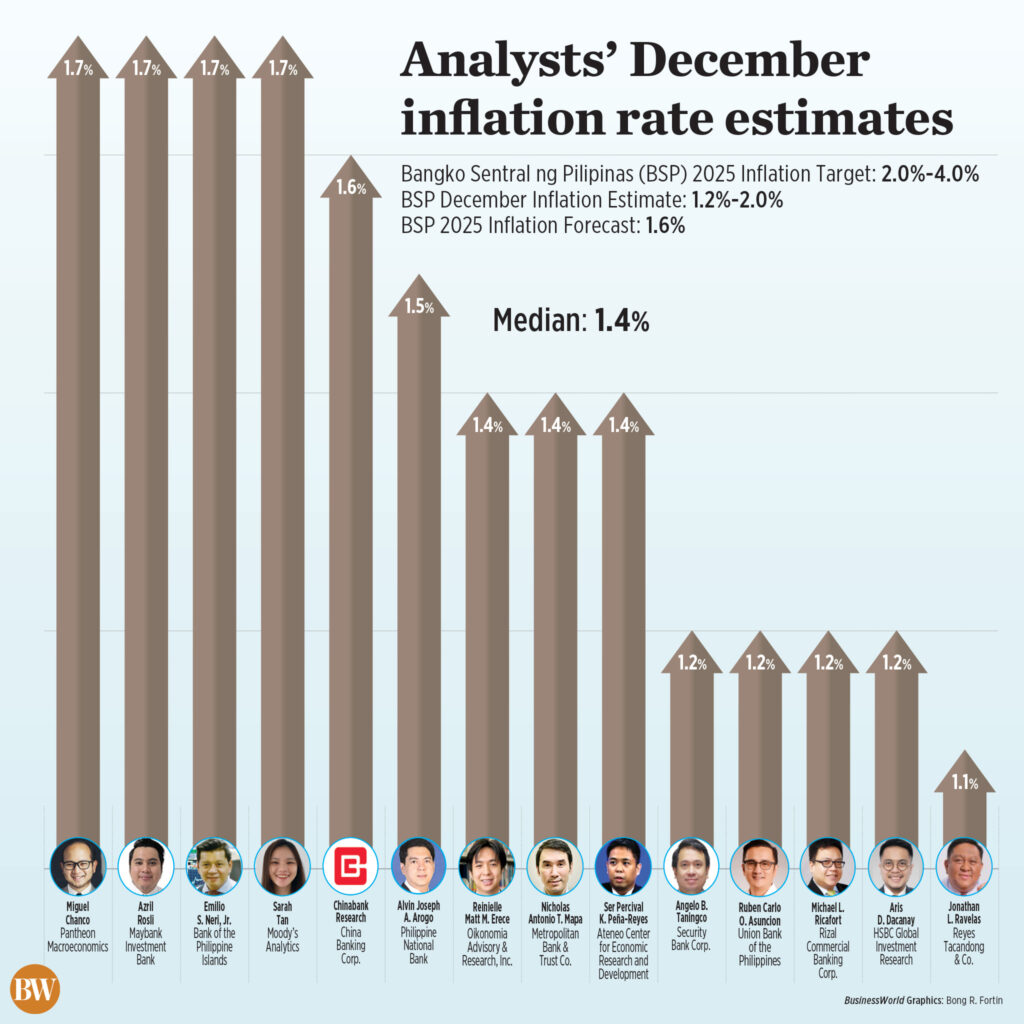

A BusinessWorld a survey of 14 analysts showed an average estimate of 1.4% for the consumer price index (CPI) in December.

This is within the Bangko Sentral ng Pilipinas’ (BSP) forecast of 1.2%-2% for the month.

If it happens, the CPI for December decreased from 1.5% in November and 2.9% in the same month in 2024.

December will also be the tenth month in a row that inflation has fallen below the central bank’s 2%-4% target.

It would similarly bring annual inflation to 1.6%, in line with the central bank’s forecast.

The Philippine Statistics Authority (PSA) will release December and full-year inflation data on Tuesday (Jan. 6).

Union Bank of the Philippines (UnionBank) Chief Economist Ruben Carlo O. Asuncion said inflation may ease in December as price pressures remain subdued despite the holiday season.

“Price pressures were limited,” he said in an email. “Although the peso remains weak, this was offset by the reduction in global oil prices towards the end of the year and the mild weather reducing electricity costs. The decline in rice capacity continued, although its impact is waning.”

In mid-December, the average price of milled rice fell 14.05% year-on-year to P42.10 per kilo from P48.98 per kilo previously, PSA data showed.

Milled rice similarly fell 9.9% year-on-year to P49.53 per kilo, while specialty rice fell 7.17% year-on-year to P58.91 per kilo.

Meanwhile, the peso closed slightly weaker on the last trading day of 2025 at P58.79 against the greenback, down 14.5 centavos from its close of P58.645 per dollar on November 28.

The head of Security Economist, Angelo B. Taningco, said that inflation may have decreased in December due to the decrease in the price of rice, fruits, oil, vegetables, fuel and electricity.

“Although holiday spending is a clear factor in the print of higher inflation, food prices remain stable,” said Reinielle Matt M. Erece, economist at Oikonomia Advisory & Research, Inc. in a Viber message.

“The prices of some food items have even decreased, especially vegetables. Electricity prices have also decreased slightly during the month, which further curbs the inflation that reduces the expected increase in the holidays due to more bonuses and remittances,” he added.

Manila Electric Co. (Meralco) last month reduced electricity rates by P0.3557 per kilowatt-hour (kWh) to P13.1145 kWh from P13.4702 per kWh in November. This is equivalent to a P71 reduction in monthly electricity bills for households using an average of 200 kWh.

Meanwhile, the pump price adjustment for December increased by P0.80 per liter of gasoline. On the other hand, diesel prices decreased by P3.80 per liter, while kerosene decreased by P4.40 per liter.

However, several analysts said inflation may have eased slightly in December.

“Inflation during the month was mainly due to lower energy and transportation costs, as well as positive effects, more than easing pressures caused by holiday-related food and local weather disturbances affecting selected foods,” Maybank Investment Bank economist Azril Rosli said in an email, noting that expects inflation to rise to 1.7%.

Moody’s Analytics economist Sarah Tan also said December inflation may rise to 1.7% due to the temporary ban on rice imports and damage to infrastructure and agriculture caused by Typhoon Kalmaegi (local name: Tino).

“These conditions will increase the pressure on the prices, not only of food but also of utilities, fuel and essential services, which will be at risk if power lines, roads and supply routes are damaged,” he added.

The National Government has extended the moratorium on the importation of regular and well-milled rice until the end of 2025.

MORE SPACE for convenience

The central bank expects inflation to return to its target this year, which is an average of 3.2% by the end of the year.

With inflation likely to be within the 2-4% target this year, analysts see more room for further monetary policy easing.

Mr. Security Bank’s Taningco said inflation appears to be reaching the top of the BSP’s target range of 3.2% in part due to underlying effects.

Alvin Joseph A. Arogo, chief economist and head of research at the Philippine National Bank, said he expects the central bank to cut the benchmark rate to 4.25% early this year before moving to “a little bit of a standstill.”

“The rate of inflation in 2026 is likely to be as high as 3.3%. This is due to the increase in wages, the adjustment of the level of services, and the negative impact of rice associated with the temporary ban on imports,” he said in an email.

Mr. UnionBank’s Asuncion sees two more 25-basis-point (bp) cuts this year, with the first likely to happen at the Monetary Board’s first annual policy meeting on Feb. 19.

“Given our inflation outlook and our expectation of moderate growth again, we expect the BSP to maintain a dovish stance but proceed cautiously,” he said. “We see two policy rate cuts in 2026, about 25 bps in the first quarter, depending on inflation remaining within target and global financial conditions remaining supportive of further potential cuts.”

The Monetary Board ended 2025 with a fifth consecutive 25-bp rate cut on Dec. 11, bringing the policy rate to a three-year low of 4.5%. So far they have reduced key borrowing costs by 200 bps from August 2024.

BSP Governor Eli M. Remolona, Jr. he previously said the central bank was nearing the end of its tapering cycle but left the door open for a final 25-bp cut this year amid low inflation and dim growth prospects.

“In 2026, the BSP will need to walk a fine line between supporting the slow economy and monitoring strong price pressure,” Ms Tan said.