Philippine FDI inflows fell by nearly 40% in October

By Katherine K. Chan, A reporter

NET INFLOWS of foreign direct investment (FDI) in the Philippines fell nearly 40% year-on-year in October, as overall foreign investment in debt instruments declined.

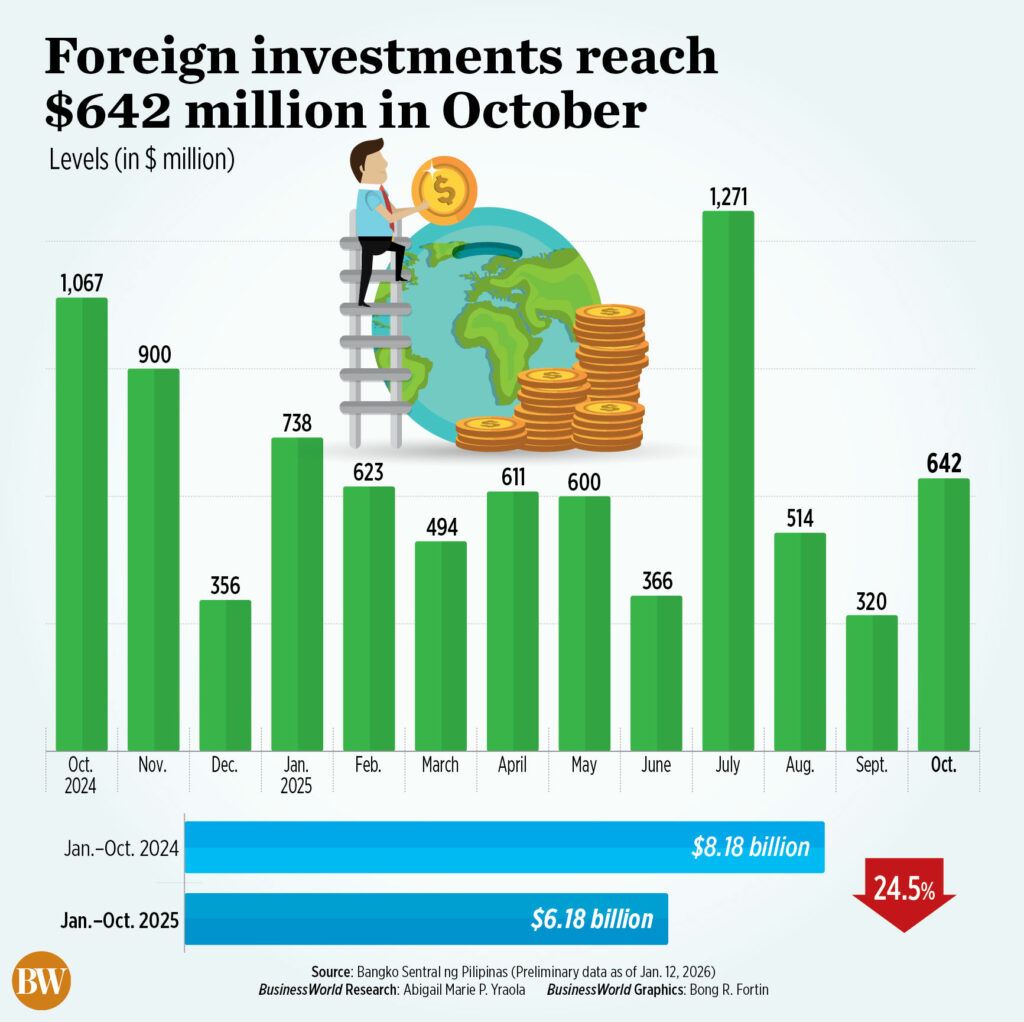

Based on preliminary data from the Bangko Sentral ng Pilipinas (BSP), net FDI inflows fell 39.8% to $642 million in October from $1.067 billion in the same month in 2024.

Despite this, October saw the highest monthly FDI level in three months or since the net inflow of $1.271 billion posted in July.

Month-over-month, revenue more than doubled (100.6%) from a five-year low of $320 million in September.

“Foreign direct investment in the Philippines generated an income of $642 million by October 2025,” the BSP said in a statement released Monday. “Japan was the leading source of FDI, with companies engaged in financial services and insurance being the largest recipients of FDI during the month.”

The year-on-year decline came as total investment by non-residents in debt instruments fell by 50.7% to $437 million from $888 million.

However, this was offset by higher inflows recorded in other FDI sectors.

Investments in stocks and mutual funds jumped 14.5% to $205 million in October 2025 from $179 million in the same month last year.

Net investment by non-residents in equities, excluding reinvestment of earnings, fell 17.1% to $117 million in October from $100 million a year earlier.

Once discounted, equity capital inflows grew 10.7% to $135 million in October from $122 million a year ago, while withdrawals fell 17.4% to $19 million from $23 million a year ago.

Meanwhile, reinvestment of earnings rose 11.3% year-on-year to $88 million in October from $79 million a year ago.

HSBC’s ASEAN Economist Aris D. Dacanay noted that the annual decline showed that persistent corruption is deterring FDI inflows, prompting investors to take a cautious “wait and see” approach.

“I think it shows that it is affected by this scandal,” he said at a press conference on Tuesday. “The sinking itself has led foreign investors to have this wait-and-see approach in the Philippines. So, I won’t say it doesn’t affect them (FDIs). What I will say is that it won’t completely cancel it.”

Last year, a series of floods that spread across the country exposed many spectacular flood control projects and implicated Public Works Department officials, legislators and private contractors in allegations of corruption.

Mr. Dacanay said Philippines’ favorable demographics, tariff advantage and a strong export sector will keep FDI on track and may even help attract more investment in the country’s export-oriented industries.

On the other hand, Jonathan L. Ravelas, senior consultant at Reyes Tacandong & Co., said the October statistics suggest that the financial decisions of companies have more weight on foreign investment than political factors.

“However, month-to-month, we pulled back because September (was) a five-year low – so October looks strong as financial cycles normalize,” he said of Viber. “The scandal of flood control has added to the noise, but the data shows that the main driver has been corporate financial decisions, not politics.”

10-MONTH SLIDE

Meanwhile, BSP data also showed that net FDI inflows fell by 24.5% to $6.179 billion as of October from $8.184 billion in the comparable period last year.

“Foreign direct investment decreased year-on-year in the month of October 2025 (-39.8%) and from January-October 2025 (-24.5%) amid external risk factors, especially Trump’s high tariffs, trade wars (and) protectionist policies that slow down the US economy and the world,” said Rizal Commercial Banking Corp. A message from Chief Economist Michael L.

Investment by non-residents in stocks and mutual fund shares reached $2.11 billion in the 10 months to October, which is 14.5% less than $2.468 billion a year earlier.

Equity investments, excluding reinvestment of earnings, fell 29.8% to $1.022 billion during the period from $1.456 billion a year ago.

This is as placements fell 16.4% year-on-year to $1.599 billion as of October from $1.912 billion last year. On the other hand, cash withdrawals increased by 26.5% to $577 million from $456 million last year.

Most equity placements in the 10-month period came from Japan, the United States and Singapore.

“The industries that received most of these investments were manufacturing, wholesale trade and real estate,” the central bank said.

Meanwhile, reinvestment by non-residents rose 7.6% to $1.088 billion from October from $1.011 billion.

However, net investment in debt instruments fell 28.8% to $4.069 billion in the period ending October from $5.717 billion a year ago.

Mr. Ravelas said the BSP’s forecast of $7 billion in net FDI inflows by the end of 2025 is still within reach, especially if investment stabilizes in the last two months of the year.

“What will help? Strong capital from Japan, the US, and Singapore, continued to invest in production, sales, and real estate, and clear management signals that reassure investors. If we remain focused on stability and change, the Philippines can continue to attract long-term capital despite the noise,” he added.

FDIs account for the investment of foreign investors in local enterprises where they hold at least 10% of the equity capital, as well as the investment of a non-resident company or its affiliates in a resident direct investor. It can be in the form of equity, income reinvestment or loan.

The BSP’s FDI data covers actual investment flows, compared to the Philippine Statistics Authority’s foreign investment data which includes potential investment commitments. fully fulfilled at a given time.