SEC clears MyNT stock splat in gcash IPO

towards Ashley Erika O. Jose, Reporting

Globe Fintech Innovations, Inc. (mynt), the operator of Gcash, has received approval from the Securities and Exchange Commission (sec) for its stock split, a development seen as a key step towards a planned public offering (IPO).

The SEC approval allows Mr. U to increase its common shares to 71.66 billion, by three hundred, while maintaining its authorized capital of P2.15 billion, Greede said in a regulatory filing on Tuesday. A stock split increases the number of shares without changing the capital of the company, effectively making each share more expensive and improving cash flow.

“We think that the stock split is done in preparation for the planned IPO of Gcash. The stock split is a common practice for planning a listing Peter Louise DC Garnace said via Viber message Businessworld.

In June, Ayala Corp. announced that Myt’s boards and shareholders have agreed to a stock split to raise the value of its common shares ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO ahead of its planned IPO. MyNT is a strategic partnership between Globe, Ayala Corp., and Ant International, a Singapore-based firm involved in digital payments and financial technology.

GOALNKS Securities and shares, Inc. Head of retail trading Allan C. Arce said the SEC’s approval shows that MyNT is actively preparing for the stock market crash. “A stock split like this often goes beyond an IPO, aligning the company’s structure with public market elements and suggesting that the regulatory and regulatory framework continues,” he said.

“Such an offer is highly relevant to Gcash, given its large user base, and will allow more retail investors to participate when the company goes public,” it added.

He saw that Globe and Ayala appeared to be restructuring to reposition the tolerance of Gcash for good market conditions, showing the management’s confidence in the needs of investors for their shares.

“It is a strategic signal that GCASH’s IPO strategy is accelerating. The restructuring of its capital shows a clear intention to unlock value and increase the availability of the Fintech list in the east,” said Mr. Arce.

According to Mr

Globe FULL TIME President Ernest L. Cu Previously told BusinessworldOne-One’s ongoing interview series focuses on growth, emphasizing its efforts to expand its user base and improve financial inclusion. In April, IPL said the IPO could happen later this year or in 2026.

Gcash currently has 94 million registered users in at least 16 markets, including the United States, United Kong, Arabia, Canabia, Qaiwa, Spain and Taiwan.

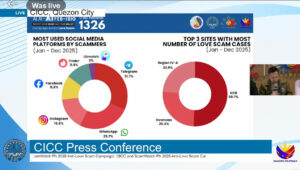

Separately on Tuesday, yesterday’s cybercrime investigation of the Ministry and Communications (CICC) said the alleged data leakage involving G-Xchange, inc.

“Further testing shows that the datasets written by the query do not originate from GCash’s systems. These findings suggest that there has not been a recent compromise of Gcash’s infrastructure,” the CCC said, adding that GCash disclosed openness to system checks.

This follows Gkash’s statement that it remains secure after a surveillance investigation found no breach of the law despite reports that user data is being sold on the dark web. The CICC said it is continuing to pursue the individuals or groups behind the reported exposure.

“Investigative efforts are ongoing to verify the origin of the uploaded data and establish any link to past cyber incidents,” CICC said. “All findings will be shared with the appropriate authorities as part of due process and in accordance with existing cybercrime investigation procedures.”

On Monday, Gkash said that the initial findings show that the trusted dataset does not match the structure used in its programs and contains entries from Gcash users, many of whom are ineligible. “