Jan’s manufacturing PMI at a nine-month high

PHILIPPINE FACTORY work In January it grew at the fastest pace in nine months amid rising production and new orders, S&P Global said on Monday.

However, the recent improvement may be short-lived as business confidence remains weak due to concerns about external demand as the global economic situation remains fragile.

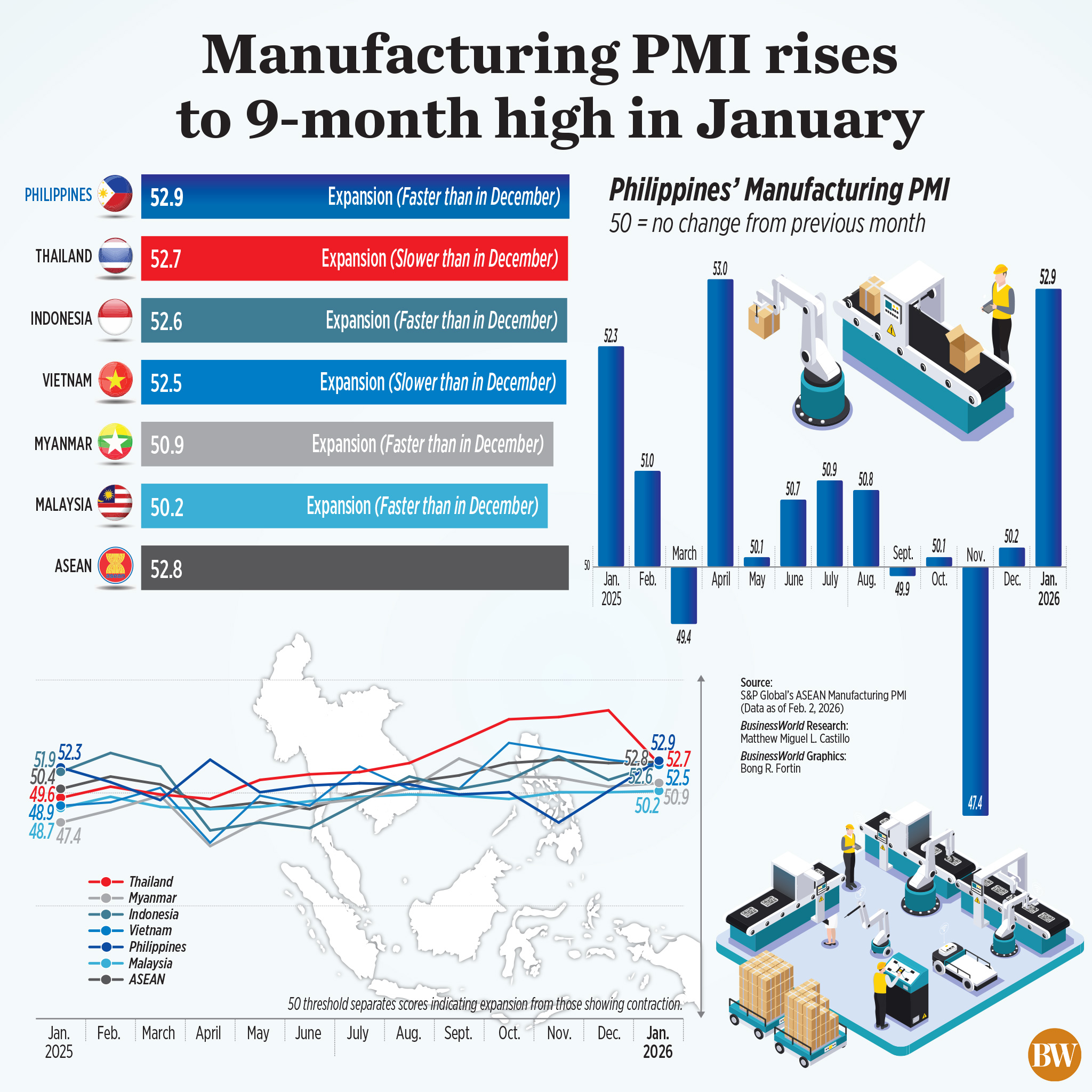

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) rose to 52.9 in January from 50.2 in December, the strongest improvement in nine months or since April’s reading of 53.

A PMI reading above 50 means better working conditions than in the previous month, while a reading below 50 indicates a deterioration.

“The renewed and strong increase in output and the rapid growth of new orders contributed positively to the expansion of the headline figure,” S&P said. “According to the overwhelming evidence, strengthening demand trends supported the recent increase in new sales, which in turn led to a renewed increase in production levels.”

The Philippines recorded the fastest expansion in manufacturing activity in the Association of Southeast Asian Nations (ASEAN) region in January, based on S&P’s ASEAN PMI data, beating Thailand’s 52.7, Indonesia’s 52.6, Vietnam’s 52.5, Myanmar’s 50.9, and Malaysia’s 50.2.

The ASEAN Manufacturing PMI reached 52.8 in January from 52.7 in December after strong growth in new orders.

“After a long period of low growth in the second half of 2025, the release of the first PMI data for 2026 points to a significant change,” said Maryam Baluch, economist at S&P Global Market Intelligence, in a report.

“New orders registered a strong and rapid increase, supported in part by increased export demand,” he added. “As a result, production returned to expanded territory for the first time in five months.”

S&P said overall order growth was supported by a “modest” increase in new factory orders received abroad, which marked the first month of growth since September last year.

With these new orders driving production, higher production requirements led to expansion employees levels, causing a two-month decline in job creation. “Although the pace of growth was slow, it was the fastest since last June.”

“Recent job growth allowed Filipino manufacturers to reduce their backlog at the beginning of the year. The rate of contracting out of joint ventures was small but marked the first decline in three months.”

Increased production demand also led manufacturing firms to increase their purchasing activity, posting the fastest growth in 12 months, S&P said.

“Furthermore, firms highlighted their stock-building choices in January as inventory holdings rose for the first time in three months. Meanwhile, post-production inventories also rose for the second straight month,” it said.

Meanwhile, manufacturers’ operating costs rose last month due to rising raw material prices, although input inflation was unchanged from December. This led the manufacturing companies to increase the prices of their goods.

Companies also reported longer lead times for filings in January, indicating continued pressure on purchasing power, S&P said.

WEAK CONFIDENCE

However, despite the high the headline PMI in January, Ms Baluch said the data showed a “worrying” drop in business confidence about future output.

“The overall sentiment has fallen to the second weakest level in history, surpassing that seen at the beginning of the COVID-19 pandemic. This reluctance reflects ongoing concerns about export demand and the sustainability of recent developments,” he said.

While companies remain optimistic that demand will improve, economic uncertainty in key export markets has dampened confidence, S&P added.

S&P Global Markets Associate Director of Economics Jingyi Pan said the improvement in manufacturing in the Philippines and across ASEAN to start the year is a “promising sign,” although concerns remain.

“Let’s remember that January was another month when the country’s anxiety spread all over the world. Then, in that itself, I think it’s something we should be aware of. But what I think is that we have seen, as I said, the employment indicator, there has been a renewal and an increase in employment. Therefore, the businesses themselves are worried, but they are still starting to hire again,” he said. Money Talks with Cathy Yang on One News on Monday.

“If the employment index doesn’t keep up with demand, if consumer stocks don’t pick up, that’s when we start to worry. But I think right now, it’s more of a wait and see…

He said they expect industrial production to decline again this year after a weak fourth quarter.

Chief Economist Rizal Commercial Banking Corp. Michael L. Ricafort said that better weather conditions and less disturbances may contribute to the increase in production at the beginning of the year.

He added that the expansion of capital here and abroad may empower producers as the low cost of borrowing will help them finance their operations and possible expansion.

Stock recovery after holidays and other seasonal factors may have supported factory activity last month, which means January’s highs may be “fading,” especially amid the poor performance of the Philippine economy last quarter, Filomeno S. Sta. Ana III, Action coordinator of Economic Reforms, said.

“What is more worrying is the decline in business confidence despite achieving productivity in January 2026. That weak business confidence will predict future performance,” he said. – Aubrey Rose A. Inosante