One million missed the HMRC tax return deadline as penalties began

Almost a million people have missed the deadline for filing their self-assessment tax returns, leaving them facing automatic penalties, according to HM Revenue and Customs.

HMRC said 27,456 taxpayers applied in the last hour before the application cut off at midnight at the end of Saturday, after the tax authority kept phone lines open and extended webchat services over the weekend in a bid to help late filers.

The busiest time for online submissions was between 5pm and 6pm on Saturday. In total, 475,722 people filed on the last day, bringing the total number of applications for the 2024-25 tax year to 11.5 million.

Anyone who fails to file on time now faces an automatic penalty of £100, even if there is no tax to pay or the tax owed has already been settled.

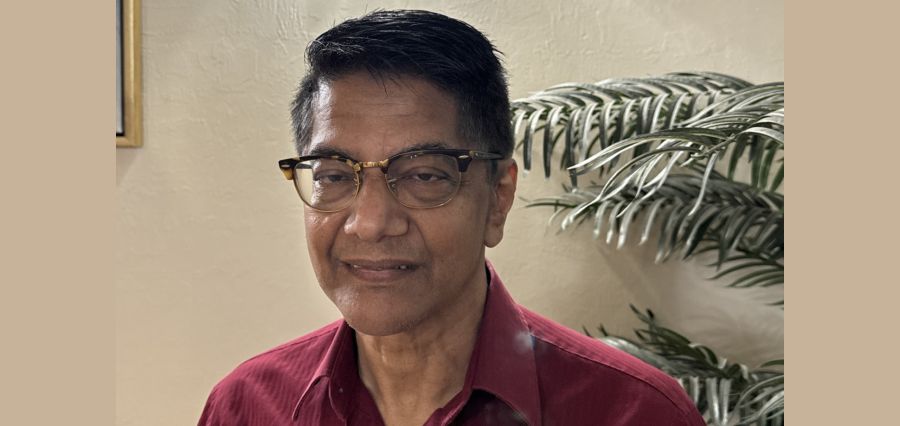

Myrtle Lloyd, HMRC’s chief customer officer, said: “Thank you to the millions of people and agents who submitted their self-assessment tax returns and paid any tax they owe by January 31. Anyone who has missed the deadline should send their returns as soon as possible, as late payment penalties and interest may apply.”

Although most employees pay tax automatically through PAYE, self-assessment remains mandatory for people with extra income. This includes those who earn more than £1,000 from self-employment, or from renting property or land during the tax year.

Some people were no longer required to submit a return this year, including those who previously had a filing requirement of more than £150,000, or parents who now pay the high-earning child benefit penalty through PAYE instead of self-assessment.

The same number of taxpayers missed the deadline last year. HMRC’s penalty process increases the longer the return is overdue. In addition to the initial £100 fine, late filers can face daily penalties of £10 after three months, capped at £900, followed by further penalties after six and 12 months.

Different penalties also apply for late tax payments, with 5% surcharges applied after 30 days, six months and 12 months, plus interest on unpaid balances.

HMRC said it will look at reasonable excuses for missing a deadline and may cancel penalties where appropriate. However, tax experts caution against delaying the move.

Charlene Young, senior pensions and savings specialist at AJ Bell, said: “Even if you intend to appeal a penalty, it’s usually wise to pay it up front to avoid interest being added if the appeal fails.

!function(f,b,e,v,n,t,s)

{if(f.fbq)return;n=f.fbq=function(){n.callMethod?

n.callMethod.apply(n,arguments):n.queue.push(arguments)};

if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version=’2.0′;

n.queue=[];t=b.createElement(e);t.async=!0;

t.src=v;s=b.getElementsByTagName(e)[0];

s.parentNode.insertBefore(t,s)}(window, document,’script’,

‘

fbq(‘init’, ‘2149971195214794’);

fbq(‘track’, ‘PageView’);