Philippine growth slows to 4.4% in 2025, slowest in 5 years

By Katherine K. Chan, A reporter

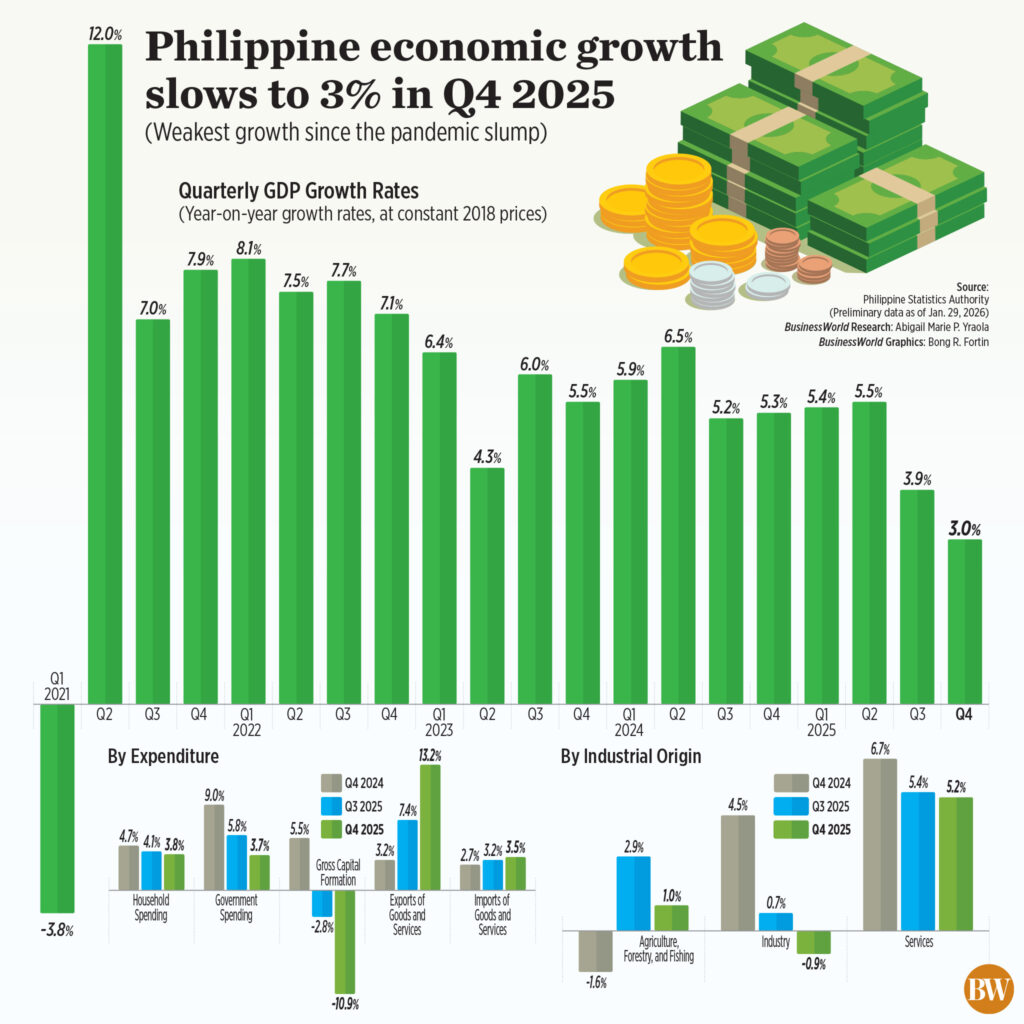

ECONOMIC GROWTH IN THE PHILIPPINES fell sharply to a post-pandemic low in the fourth quarter of 2025 as the flood control crisis continues to weigh on government spending, investment and consumer spending, drag extending a full year below target for the third year in a row.

The Philippine Statistics Authority (PSA) reported on Thursday that the fourth quarter gross domestic product (GDP) grew by 3%, from 5.3% in the fourth quarter of 2024 and a revised print of 3.9% in the third quarter of 2025.

The decline was surprising as the fourth quarter is typically a strong period for growth, due to holiday spending. The latest print stands out as the weakest fourth quarter performance in five years or from an 8.2% contraction. in the fourth quarter of 2020.

Excluding the pandemic, it was the worst quarterly growth rate in 16 years or since 1.8% in the fourth quarter of 2009, but similar to 3% in the third quarter of 2011.

On a quarter-on-quarter adjusted annual basis, the economy grew by 0.6%.

In 2025, the economy grew by 4.4%, very weak compared to 5.7% growth in 2024.

This was the weakest pace in five years or when GDP fell by 9.5% in 2020. Apart from the epidemic, it has been a slow growth since the growth of 3.9% in 2011.

The full-year average also fell below the Development Budget Coordinating Committee (DBCC) target of 5.5%-6.5%.

Recent growth has also turned out to be weaker than market expectations, as a BusinessWorld a survey of 18 economists last week showed an average of 4.2% in the October to December period and 4.8% in 2025.

Economy Secretary Arsenio M. Balisacan said the slow growth reflects the impact of bad weather on economic activities and the scandal of corruption on consumers and investors.

“Admittedly, the corruption of flood management has also affected business and consumer confidence. These challenges have occurred along with economic uncertainty around the world,” he said while speaking on Thursday.

Mr. Balisacan, who previously expected full-year growth to reach 4.8-5%, said he did not expect such a “sharp” decline. However, he said that economic managers expected that there would be consequences for the changes made after the fraud case.

“It will not be business as usual. Because otherwise, we may have growth this year, or last year, the growth may be high, but with corruption everywhere, or in the infrastructure. That (growth) would not be expected to last long. It is better that we go slowly, fix the problems, and build the trust of our people in the government,” said Mr. Balisacan.

A scandal involving government officials, lawmakers and private contractors in multibillion-peso corruption in flood control projects has dragged down government spending and spending since the third quarter last year.

USEFUL USE

In the fourth quarter, household consumption, which accounts for more than 70 percent of the country’s GDP, rose 3.8%, down from 4.7% last year and 4.1% in the third quarter. This was the slowest growth in household spending since the -4.8% seen in the first quarter of 2021.

For the full year, consumption growth slowed to 4.6% from 4.9% in 2024.

Meanwhile, government spending grew by 3.7% in the fourth quarter, slowing from 9% in the same period in 2024 and 5.8% in the third quarter. It was also the slowest since 2.6% in the first quarter of 2024.

Overall government spending on construction fell by 41.9% during the last three months of 2025, as the government increased the scrutiny of infrastructure projects.

In 2025, government spending grew by 9.1%, faster than 7.3% last year.

Mr. Balisacan said the government’s participation program could help increase public spending, especially construction, in the first half.

“The release of the 2026 budget approval has been slightly delayed,” he added. “And that can have a negative impact on spending, especially on community building.”

The PSA data is also tellingwe found that gross domestic product, which is part of economic investment, fell 10.9% in the fourth quarter, the biggest drop since early 2021. This was a sharp decline from the -2.8% in the third quarter and a 5.5% decline in growth in the fourth quarter of 2024.

By 2025, investment has decreased by 2.1%.

BETTER DELIVERY

Meanwhile, growth in exports provided some relief to the economy as it rose 13.2% in the fourth quarter, up from 3.2% last year and 7.4% in the third quarter. For the year as a whole, exports grew by 8.1%.

Imports, on the other hand, grew by 3.5% in the October to December period, from 2.7% last year and 3.2% in the previous quarter, bringing its full-year growth to 5.1%.

The government predicts exports of goods and services will increase by 2% and 5% respectively, this year.

According to the PSA, the agriculture, forestry, and fishing (AFF) sector grew by 1% in the fourth quarter, while services grew by 5.2%. However, the industrial sector saw a 0.9% decline in the fourth quarter.

In 2025, the AFF, service and industry sectors grew by 3.1%, 5.9%, and 1.5% respectively.

National statistician Claire Dennis S. Mapa said wholesale trade and car and motorcycle repair are the major contributors to the country’s growth.

Meanwhile, the Philippines’ gross domestic product rose 3.9% in the fourth quarter. Last year, it increased by 6.1%, down from 7.7% in 2024.

The country’s gross domestic product also increased by 10.9% in the October to December period, bringing the 2025 average to 19.1%. This is down from 26.6% the previous year.

MEDIATION IS DELAYED

Meanwhile, Mr. Balisacan said that the country’s chances of immediate repatriation may be slim now.

“(W)e see 2026 as our meeting point,” he said. “And with all these events happening and our ASEAN (Association of Southeast Asian Nations) chairmanship, it should be able to turn the corner and get the economy back on track early in the second quarter of this year.”

He mentioned that the ongoing effects of corruption and the delay in the passage of the 2026 budget could prevent the economy from recovering in the first quarter of the year.

“We do not expect that the growth will reach the peak of the first quarter because we are expecting the ongoing results of those measures, especially if this year’s budget is released or approved late,” he said.

On Jan. 5, President Ferdinand R. Marcos, Jr. signed the General Appropriations Act of 2026, allocating a P6.793-trillion budget for the government.

Emerging Economist of Pantheon Macroeconomics, Miguel Chanco, said that the economic stagnation that occurred in the fourth quarter may continue to result in the country’s growth in the near future.

“All these weaknesses seem to be dissipated at the beginning of this year, as we are yet to see how much the government’s infrastructure spending will decrease in monthly figures, while the expansion plans considered by private companies continue to grow strongly,” said Mr. Chanco writing via email.

The outlook for the Philippine economy remains bleak, especially if ongoing governance issues are left unresolved, notes ANZ’s Southeast Asia and India Research Economist Sanjay Mathur.

“Looking ahead, growth may remain weak until governance-related issues are resolved, and public spending begins to improve,” he said in the report. “Although support from other countries will stabilize in the next few months due to the technology cycle related to AI (artificial intelligence), the overall impact will be limited.”

Meanwhile, Chinabank Research said the poor performance of the economy in the fourth quarter calls for the urgent implementation of reforms, adding that global uncertainty threatens the country’s external position.

“This underscores the need to advance economic climate protection and rebuild public confidence to support domestic needs, especially as the front faces continued headwinds from an uncertain and volatile global environment,” it said.

This year, DBCC is targeting 5%-6% GDP growth.