Trade deficit narrows to 4 years by 2025

By Abigail Marie P. Yraola, Deputy Head of Research

Trading in goods in the Philippines shortage dropped to less than four years by 2025, as exports rose by double digits and import growth remained muted, the Philippine Statistics Authority (PSA) reported on Tuesday.

Analysts said the narrowing trade deficit may have helped provide a modest boost to gross domestic product (GDP) growth in 2025.

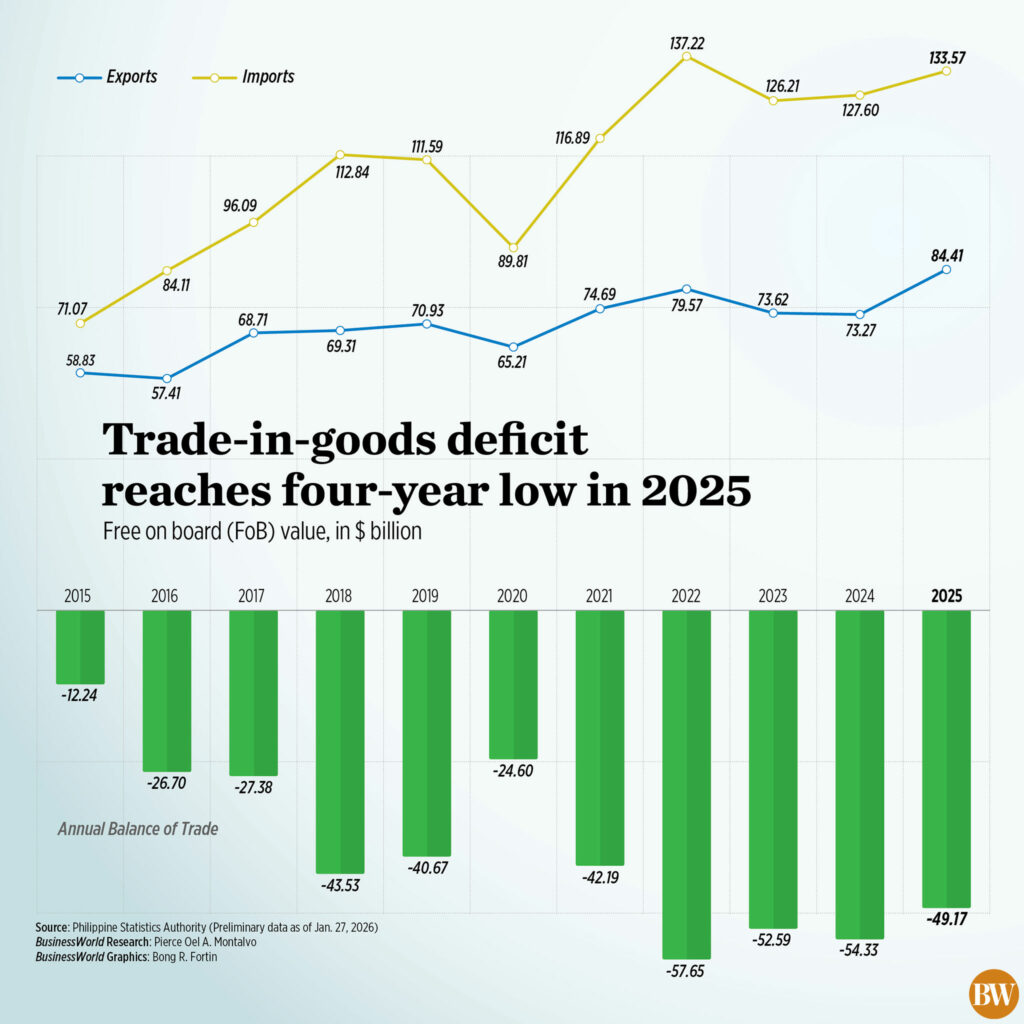

Preliminary data from the PSA showed the country’s trade deficit fell 9.5% year-on-year to a $49.17-billion deficit in 2025, narrower than the $54.33 billion gap a year earlier.

This was the smallest trading gap in four years or so $42.19-billion deficit by 2021.

Exports rose 15.2% to $84.41 billion last year, better than the government’s forecast of a 2% decline. The increase in exports was a reversal from a 0.5% decline in exports in 2024.

Meanwhile, imports grew by 4.7% year-on-year to $133.57 billion by 2025, faster than the 3.5% growth expected by the government this year. This is also faster than the 1.1% gain in 2024.

The trade deficit in 2025 narrowed year-on-year due to better-than-expected performance and the appetite for imports, Marco Antonio C. Agonia, an economist at the University of Asia and the Pacific, said in an email.

“On the export side, trade uncertainty has encouraged offloading to avoid indirect tax declarations, [and were] and it is helped by the weakness of the peso, which makes the export of goods more expensive,” he said.

Weak domestic demand, following a corruption scandal and a series of natural disasters, coupled with a weakened peso, has reduced imports, he added.

Miguel Chanco, emerging Asia economist at Pantheon Macroeconomics, said the narrowing trade deficit was due to a real recovery in exports, which grew by 15% compared to last year.

“In the second half of 2025, this integration was helped by imports that performed very poorly, which is great for trade income but bad for what it means for the Philippine economy, given that there is a lot of demand at home.”

George T. Barcelon, chairman of the Philippine Chamber of Commerce and Industry (PCCI), said that since the US introduced repeated tariffs, orders were held back as businesses were unsure how to proceed and what tariffs would apply.

“At least 19% (prices) were considered as one of the lowest average costs. So, the business continues,” he said while talking on the phone.

The United States imposed a 19% tariff on Philippine goods effective Aug. 7.

DECEMBER SHORTAGE

In December, the trade deficit decreased to $3.52 billion from a gap of $4.15 billion in the same month in 2024, a decrease of 15%.

It was the smallest trade balance in 10 months or since the $2.97 billion entered in February 2025.

Total sales of goods made in the Philippines fell 23.3% year-on-year in December to $6.99 billion, faster than the 21.6% growth in November and a reversal from a 1.9% decline in the same month in 2024.

It was the fastest pace of exports in six months or since a 26.9% increase in June last year.

By value, December exports were the highest in two months or since the $7.45 billion exported in October 2025.

On the other hand, consumer goods sales rose 7.1% year-on-year to $10.52 billion in December, faster than a 2.3% gain in November and a change from a 1.4% contraction in the same month in 2024.

The import bill was the smallest in ten months or since $9.76 billion in February.

To Mr. Agonia, the small loss of trade may provide a small improvement in GDP figures for the fourth quarter and the full year, but it is impossible to change the result of low government spending and weak investor confidence and consumer confidence following corruption scandals.

The PSA will be reporting GDP data for the fourth quarter and full year in Jan. 29, Thursday.

SUBMISSIONS ARE VISIBLE AGAIN

In the main category of goods, manufactured goods, which make up 80.1% of total exports, increased by 15.8% to $67.62 billion in 2025.

For goods, electronic products, which accounted for more than half of total exports (54.4%) jumped by 17.6% to $45.96 billion last year.

Semiconductors, a subset of electronic products that account for the bulk of electronic product sales, rose 18.7% to $34.62 billion.

“Exports will play a strong role in 2025, far outstripping import growth due to strong demand for semiconductors,” Chinabank Research said in a research note.

It said exports rebounded in 2025 after two years of decline, despite initial concerns that exports would face challenges amid an uncertain global trade environment.

Chinabank Research said overseas demand for semiconductors remained a key driver of the strong year-end performance.

“Global demand connected to AI (artificial intelligence), electric vehicles, and data centers is expected to continue to support demand this year,” it added.

Meanwhile, other manufactured goods increased by 31.1% last year to $6.13 billion, followed by machinery and transportation equipment which increased by 34.3% to $3.55 billion.

In 2025, the United States became the leading destination for exports of domestically produced products with a share of 15.9% worth $13.44 billion.

It was followed by Hong Kong, which is a 14.6% share ($12.32 billion), Japan with a 13.7% share ($11.57 billion), China with an 11% share ($9.3 billion) and the Netherlands with a 4.3% share ($3.6 billion).

GROWTH WAS SILENCED

Raw materials and intermediate goods, which make up the country’s total gross domestic product (36.1% share) increased by 3.7% to $48.21 billion in 2025.

Imports of capital goods grew by 13.2% to $40.45 billion in 2025, while consumer goods jumped by 7.3% to $27.71 billion.

Of the imported goods, electronic products which made up 23.9% of the country’s total imports made up the majority of manufactured goods. It increased by 16.7% to $31.94 billion by 2025.

Imports of semiconductors increased by 20.1% to $22.22 billion in 2025.

On the other hand, imports of petroleum, lubricants and related products decreased by 12.5% to $16.69 billion. This accounted for 12.5% of the country’s total import share.

Imports of transportation goods rose 10.5% to $12.55 billion last year from $11.36 billion in 2024.

By 2025, China was the country’s largest source of imports with a 28.6% share worth $38.22 billion. South Korea followed with a share of 7.9% ($10.58 billion), Japan with 7.9% ($10.52 billion), Indonesia with 7.6% ($10.16 billion) and the United States with 6.1% ($8.11 billion).

“The trade figures will probably normalize in 2026,” said Mr. Agony as ongoing political and trade uncertainty continues to slow global growth, while fundamentals from last year’s results may impact trade performance this year.

Chinabank Research said the country’s export performance this year will be supported by continued demand for chips related to advanced technology.

“However, the volatile global environment – between renewed US tariff threats and regional tensions – poses risks to foreign demand,” he said.

Mr. Chanco said it will be difficult for the Philippines to replicate the strong growth in exports this year, “as global growth will slow down significantly and the imposition of higher US tariffs in the middle of last year may be fully felt.”

“The higher base results from the pre-loading of exports to the US, before the tariff, will act against the growth of the export heading this year,” he added.